Here you will find all information on the current delivery situation of materials as well as changes in the delivery process due to global events.

Current: 2024 container shortage, red sea situation and rate increases

17.06.2024 Ship capacities, increase in freight rates & forecast until October

Shipping capacity remains tight. Current situation will continue until at least October

The rollercoaster ride on the sea freight market is taking on a level previously only seen during the coronavirus pandemic. Cargo space and containers are fully booked for weeks in the Far East, freight rates are rising and ships are piling up at the ports. If you take the SCFI spot freight index as a barometer, the market is already more than halfway to the record levels of the pandemic period. At that time, the index reached around 5,000 points, then fell back to the historical average of 1,000, and is now back at around 3,200. This time, it is not the problems in ports and logistics centers and the e-commerce boom that are driving the market upwards, but the greatly extended travel distances of ships as a result of the safety crisis in the Red Sea.

In terms of total global container traffic, demand for transport capacity (TEU miles) has increased by 11% due to the bypass of Africa, according to British shipbroker Clarksons - without any additional cargo volume. In the coming weeks, a further shortage of space is expected in Asian ports as the annual peak season for Christmas orders begins - earlier than usual, because importers want to play it safe. Calculations by Linerlytica show that the capacity gap on the main routes ex Far East could grow to up to 20 percent in July. Market researchers at Sea-Intelligence warn that freight rates for shipments from China to Europe could shoot up to over 20,000 dollars/FEU and even exceed pandemic levels.

How long the boom lasts depends on when the situation in the Red Sea calms down and the ships can return to the Suez route. However, the future of Middle East politics remains to be seen. From a purely operational point of view, customers must be prepared for the fact that the ship systems and routes will not be changed until Golden Week in China at the beginning of October, according to insiders. A change in procedures during the current peak season could lead to even greater turbulence, it is said.

10.08.2022

NEVER ENDING TRAFFIC JAM

Although container shipping operations did not deteriorate any further in July, there was hardly any improvement in sight. However, there is hardly any improvement in sight. The situation in the trade in goods and merchandise thus remains tense.

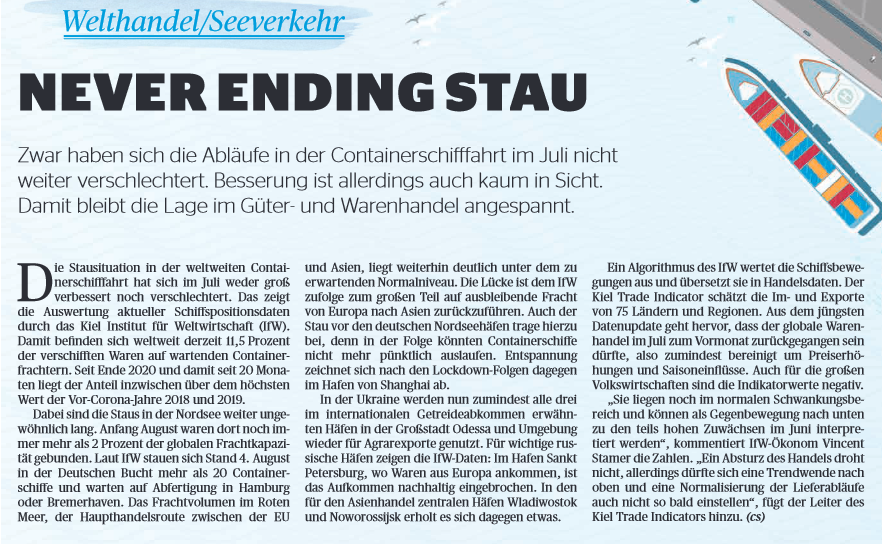

The congestion situation in global container shipping neither improved nor worsened in July. This is shown by the evaluation of current ship position data by the Kiel Institute for the World Economy (IfW). Thus, 11.5 % of shipped goods worldwide are currently on standing container carriers. Since the end of 2020, and thus for 20 months, the share is now above the highest value of the pre-Corona years 2018 and 2019.

At the same time, congestion in the North Sea continues to be unusually long. At the beginning of August, more than 2% of global freight capacity was still tied up there. According to the IfW, as of August 4, more than 20 container ships are jammed in the German Bight, waiting for clearance in Hamburg or Bremerhaven. Cargo volumes in the Red Sea, the main trade route between the EU and Asia, remain well below the expected normal level. According to the IfW, the gap is largely due to a lack of cargo from Europe to Asia. The congestion off the German North Sea ports also contributes to this, as container ships can no longer leave on time as a result. In contrast, there are signs of relief at the port of Shanghai following the lockdown.

In Ukraine, at least all three ports mentioned in the international grain agreement in the major city of Odessa and the surrounding area are now being used again for agricultural exports. For important Russian ports, the IfW data show: In the port of Saint Petersburg, where goods arrive from Europe, there has been a sustained slump in volumes. The ports of Vladivostok and Novorossiysk, which are central to Asian trade, are recovering somewhat.

An algorithm developed by the IfW evaluates ship movements and translates them into trade data. The Kiel Trade Indicator estimates the imports and exports of 75 countries and regions. The latest data update shows that global trade in goods is likely to have declined in July compared with the previous month, i.e. at least adjusted for price increases and seasonal effects. Indicator readings are also negative for the major economies. "They are still within the normal fluctuation range and can be interpreted as a downward countermovement to the partly high increases in June," IfW economist Vincent Stamer comments on the figures. "A crash in trade is not imminent, but a trend reversal upwards and normalization of supply processes is not likely to occur any time soon," adds the head of the Kiel Trade Indicator,

Source: Newspaper article on the state of global supply chains - 10.08.2022

10.08.2022

Constantly out of sync - When will global supply chains recover?

When will global supply chains recover? While there are signs of improvement, there are also new risks. So the acid test continues for the time being.

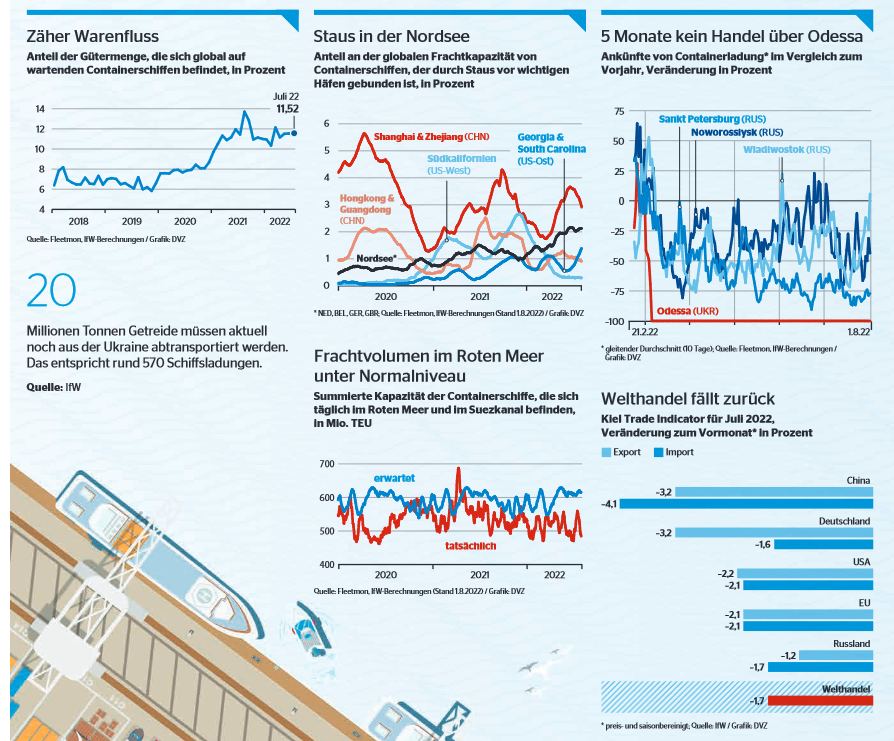

Supply bottlenecks continue to have a firm grip on German manufacturers. Almost three quarters of companies reported a shortage of materials in the Ifo Institute's economic surveys in July. And according to economic researchers, there is no improvement in sight for the next few months.

According to the IfW, more than 2% of global freight capacity is still tied up in the North Sea alone due to container ship congestion. A large part of this is in the German Bight. The electrical industry in particular is suffering from the supply problems. Christian Reinwald, responsible for product management at Reichelt-Elektronik, says "because important components manufactured in China are missing." As before, disrupted supply chains are weighing on the business.

Delivery delays make it difficult for supply chain managers to coordinate pickups. This is compounded by a lack of intermodal capacity. If lockdowns in China occur again this year, there will be no improvement in terms of punctuality in maritime transport.

Kamala Raman says "supply chains are undoubtedly moving." But in the transformation, not all companies were moving in the same way. It would have changed your networks and different ways, whether through expansions, consolidations or simply changes to buffers. In a survey, however, 400 executives indicated that large-scale nearshoring would not occur. However, companies are looking at whether there could be a China-plus-one approach. Here, for the most part, the China-based network would remain in place, but there would be the possibility of new locations in other markets.

However, the stress level remains high for the time being. The Global Supply Chain Pressure Index (GSCPI) was recently introduced as a measure of supply chain pressure. It shows how tense >0 or relaxed <0 the situation is.

Read the whole article, click on the picture.

Source: Newspaper article by Claudius Semmann on the state of global supply chains - 10.08.2022

07.04.2022

Shanghai lockdown extended until further notice

The closure of the Shanghai urban area has not yet been lifted.

The Shanghai districts of Pudong and Puxi remain closed until further notice:

-Most factories in Shanghai and surrounding areas remain closed

-Restrictions on overland transportation: -Shanghai trucks may move only with special permits

-Only 30 % of all trucks have received this special permit

-Drivers are not allowed to leave their cabs when making deliveries inside and outside Shanghai.

The container terminals and airport in Shanghai are in operation, but only limited volumes of FCL, LCL and air cargo can be transported due to strict restrictions on land transportation. The container yards and air cargo halls have reached their capacity limits.

Please note that due to these restrictions, higher trucking costs, possible port storage fees, demurrage and detention costs may apply.We use alternative sea and air ports whenever possible to handle your goods with minimal delays.

We kindly ask you to place your bookings as early as possible, as we expect an increased volume of shipments after the blocking has been lifted.

Source: Extract from a customer information LOGWIN - 07.04.2022

15.03.2022

Tighter measures in the Chinese metropolises of Shanghai and Qingdao

The number of COVID-19 cases in the Shanghai and Qingdao regions has continued to rise in recent days.

Residents of the two cities were asked not to leave the region until further notice. In addition, local control measures were tightened:

-Truck drivers must present a negative COVID-19 test that is no more than 48 hours old.

-The stricter control measures lead to delays in the pre- and post-production

-Bordering regions do not accept drivers from the Shanghai and Qingdao risk areas.

Handling at the airports and seaports of Shanghai and Qingdaol is currently continuing.

However, local COVID-19 measures and restrictions result in limited availability of driving personnel and short-term shifts in pickup and delivery.

Please be prepared for possible delays in local shipments to and from these regions in the coming weeks.

Source: Extract from a customer information LOGWIN - 15.03.2022

15.03.2022

Local Chinese authorities order lockdown for Shenzhen / Yantian

In recent days, the number of COVID-19 cases has increased rapidly in the Shenzhen metropolitan region.

To counteract this development, the local government has ordered a lockdown from March 14-March 20, 2022. All companies are

obligated to transfer your activities to the home office or to stop work during the aforementioned period. The consequences are:

-The production in Shenzhen will be shut down

-Additional restrictions and control measures in the Dongguan region.

-The LCL activities in the warehouses of Shenzhen& Yantianwere discontinued

Handling at Shenzhen's sea terminals(Chiwan, Shekou, Yantianand Da Chan Bay) are currently not affected by the measures.

Please check with your suppliers in the region if there are any postponements of current shipments due to production.

Please book your shipments as early as possible, as we expect increased booking volume after the lockdown.

Source: Extract from a customer information LOGWIN - 15.03.2022

14.03.2022

Exploding energy prices and pallet shortages

The effects of the war in Ukraine are increasingly affecting all areas of our daily lives, including logistics. In addition to the already recognizable impact in the area of driver shortages, the price of diesel and also the rising price of pallets are obviously playing an important role.

Within one week alone, diesel prices have risen by an average of over 30 %. The immediate effects are felt by everyone who fills up privately. Particularly truck entrepreneurs, whose vehicles consume depending upon size and extent of utilization between 20 - 35 liters per hundred kilometers, fight ad hoc with cost increases of over 15,00 € per hundred km, or on an exemplary driving performance of 600 km calculated, with more than 90,00 € per day and vehicle, dimensions as it never gave it before.

In addition to the actual amount, it is above all the dynamics that pose extreme challenges for transport companies and freight forwarders here. Diesel surcharges were usually calculated on the basis of average values from previous months, and adjustments were usually made with a significant time lag. However, the current situation requires us to take the extreme situation into account promptly and react more quickly here.

We will therefore no longer link the stored diesel price models to the previous month's values, but take into account the development at weekly level. We must also pay particular attention to partial and full loads, as the diesel surcharges here are often out of proportion to the actual additional charges. This also applies in particular to international full truck loads. We ask for your understanding that in individual cases there may be an increased diesel surcharge for such transports.

But the availability of pallets is also affected by the war, as the production and supply situation of pallet wood and pallets is interrupted. Already for months, the cost of euro pallets has more than doubled. At the beginning of the year, fortunately, there were slight signs of relief, but due to the war and sanctions, unfortunately, the situation has again developed exactly in the other direction. It is realistic to fear that not only prices will continue to rise again, but that an increasing shortage will develop.

Everyone in the transport chains must coordinate closely and in partnership in order to master this complex and cost-intensive issue together. This concerns the costs for pallet exchange, but also the depreciation of quantities, as well as very practically any depreciation of damaged or not nice pallets on delivery. Only by dealing fairly can cost explosions and bottlenecks be avoided here.

You can be sure that even in these difficult times Schmidt-Gevelsberg is working very intensively with its long-standing network partners and transport companies to be able to meet every one of your logistical requirements in the best possible way.

Source: Extract from a customer information of the forwarding company Schmidt-Gevelsberg - 14.03.2022

21.02.2022

Hurricane-force storms bring handling to a standstill at terminals in northern Europe

Three successive hurricane lows have been moving across Northern Europe since February 18.

All modes of transport are still affected in their operations:

-Rail freight traffic to and from the seaports is severely delayed.

-The transshipment in the seaports had to be suspended several times, loading closures, departures and arrivals are out of the schedule.

-Some of the flights have been cancelled or are delayed

-Existing reservations were lost and time slots had to be re-booked

Airports will soon make up for lost time. Rail services and seaport terminals, on the other hand, will need the following weeks to return to normal operations.

Therefore, please expect longer transit times, last-minute schedule changes and further delays.

We ask for your understanding that there may be demurrage, storage charges and costs for demurrage and detention, which are to be borne by the cargo owner.

Source: Extract from a customer information of the company LOGWIN - 21.02.2022