Here you will find all information regarding the current supply situation of aluminium, wood, steel and freight.

General

Information

The material surcharge (MTZ) does not include any surcharges and corresponds to the pure additional costs for the seat plates incurred due to the procurement situation. Due to the massive order volume with extended lead times, we reserve the right to adjust the MTZ to the circumstances from case to case.

Due to the long delivery time for steel, this cannot be represented in any other way, since the more expensive material goes directly into production and is processed into the end product for you.

Unfortunately, we are also forced to buy at ever higher purchase prices and more extreme purchasing conditions in order not to endanger the supply chains. Therefore, we have to levy inflation surcharges. A forecast for the further price development is not possible at this point in time.

We hope for an easing of the situation soon.

Your team from proroll & NORTHCOMP

10.08.2022

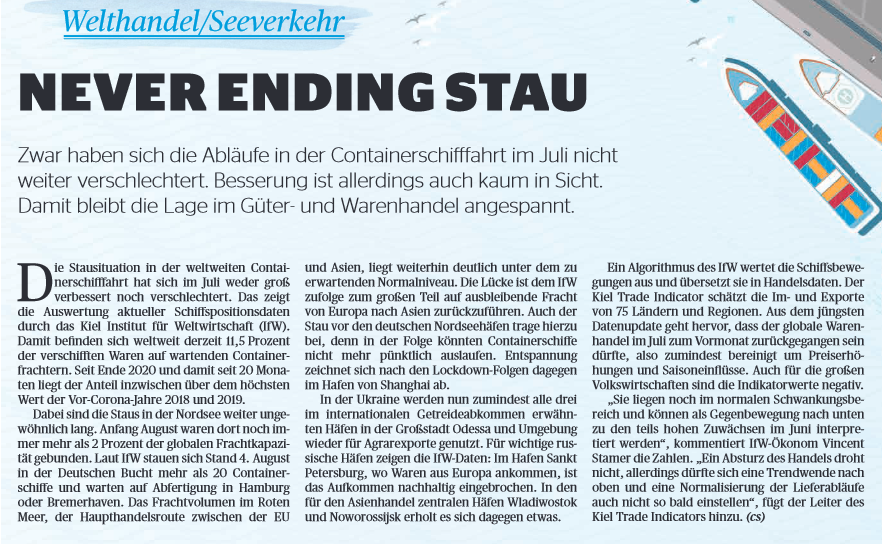

NEVER ENDING TRAFFIC JAM

Although container shipping operations did not deteriorate any further in July, there was hardly any improvement in sight. However, there is hardly any improvement in sight. The situation in the trade in goods and merchandise thus remains tense.

The congestion situation in global container shipping neither improved nor worsened in July. This is shown by the evaluation of current ship position data by the Kiel Institute for the World Economy (IfW). Thus, 11.5 % of shipped goods worldwide are currently on standing container carriers. Since the end of 2020, and thus for 20 months, the share is now above the highest value of the pre-Corona years 2018 and 2019.

At the same time, congestion in the North Sea continues to be unusually long. At the beginning of August, more than 2% of global freight capacity was still tied up there. According to the IfW, as of August 4, more than 20 container ships are jammed in the German Bight, waiting for clearance in Hamburg or Bremerhaven. Cargo volumes in the Red Sea, the main trade route between the EU and Asia, remain well below the expected normal level. According to the IfW, the gap is largely due to a lack of cargo from Europe to Asia. The congestion off the German North Sea ports also contributes to this, as container ships can no longer leave on time as a result. In contrast, there are signs of relief at the port of Shanghai following the lockdown.

In Ukraine, at least all three ports mentioned in the international grain agreement in the major city of Odessa and the surrounding area are now being used again for agricultural exports. For important Russian ports, the IfW data show: In the port of Saint Petersburg, where goods arrive from Europe, there has been a sustained slump in volumes. The ports of Vladivostok and Novorossiysk, which are central to Asian trade, are recovering somewhat.

An algorithm developed by the IfW evaluates ship movements and translates them into trade data. The Kiel Trade Indicator estimates the imports and exports of 75 countries and regions. The latest data update shows that global trade in goods is likely to have declined in July compared with the previous month, i.e. at least adjusted for price increases and seasonal effects. Indicator readings are also negative for the major economies. "They are still within the normal fluctuation range and can be interpreted as a downward countermovement to the partly high increases in June," IfW economist Vincent Stamer comments on the figures. "A crash in trade is not imminent, but a trend reversal upwards and normalization of supply processes is not likely to occur any time soon," adds the head of the Kiel Trade Indicator,

Source: Newspaper article on the state of global supply chains - 10.08.2022

10.08.2022

Constantly out of sync - When will global supply chains recover?

When will global supply chains recover? While there are signs of improvement, there are also new risks. So the acid test continues for the time being.

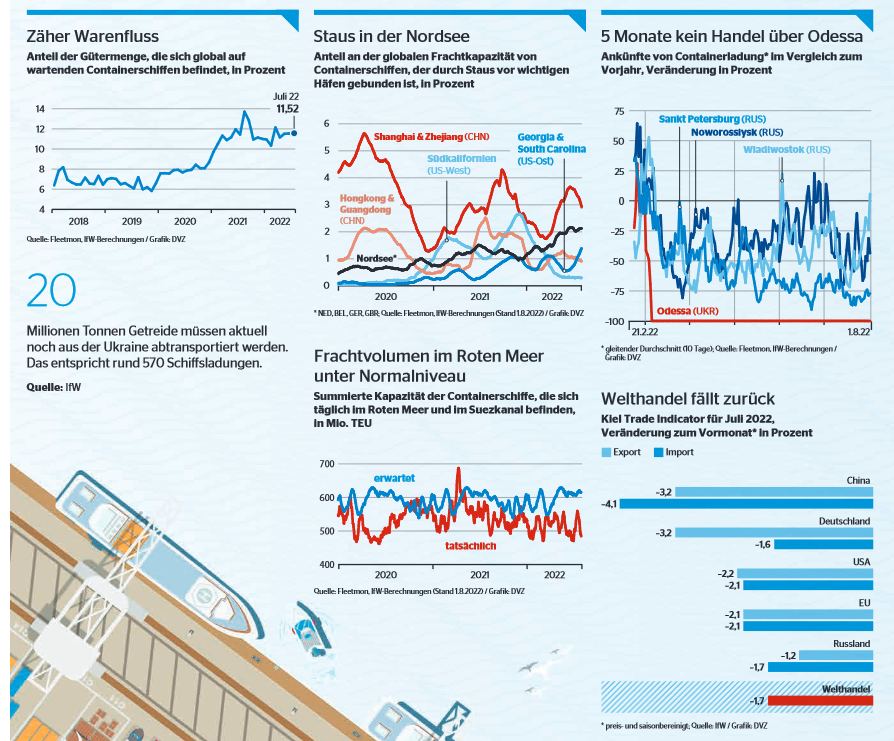

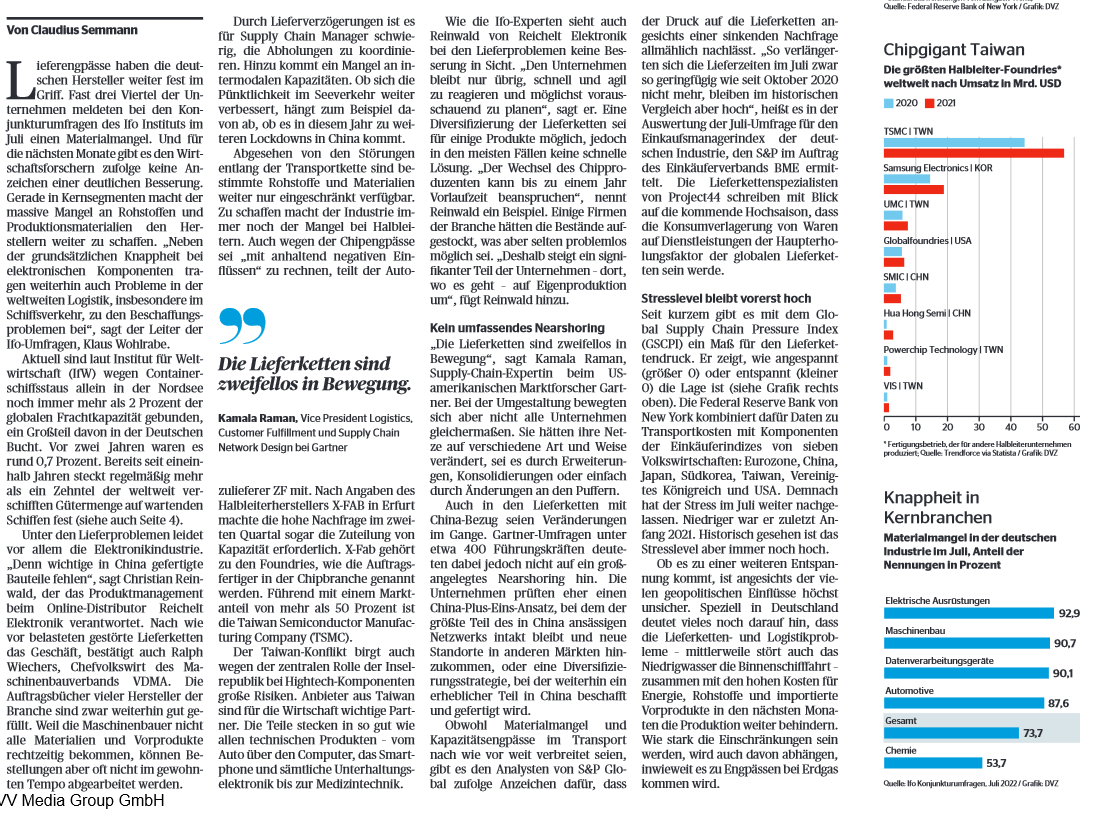

Supply bottlenecks continue to have a firm grip on German manufacturers. Almost three quarters of companies reported a shortage of materials in the Ifo Institute's economic surveys in July. And according to economic researchers, there is no improvement in sight for the next few months.

According to the IfW, more than 2% of global freight capacity is still tied up in the North Sea alone due to container ship congestion. A large part of this is in the German Bight. The electrical industry in particular is suffering from the supply problems. Christian Reinwald, responsible for product management at Reichelt-Elektronik, says "because important components manufactured in China are missing." As before, disrupted supply chains are weighing on the business.

Delivery delays make it difficult for supply chain managers to coordinate pickups. This is compounded by a lack of intermodal capacity. If lockdowns in China occur again this year, there will be no improvement in terms of punctuality in maritime transport.

Kamala Raman says "supply chains are undoubtedly moving." But in the transformation, not all companies were moving in the same way. It would have changed your networks and different ways, whether through expansions, consolidations or simply changes to buffers. In a survey, however, 400 executives indicated that large-scale nearshoring would not occur. However, companies are looking at whether there could be a China-plus-one approach. Here, for the most part, the China-based network would remain in place, but there would be the possibility of new locations in other markets.

However, the stress level remains high for the time being. The Global Supply Chain Pressure Index (GSCPI) was recently introduced as a measure of supply chain pressure. It shows how tense >0 or relaxed <0 the situation is.

Read the whole article, click on the picture.

Source: Newspaper article by Claudius Semmann on the state of global supply chains - 10.08.2022

07.04.2022

Shanghai lockdown extended until further notice

The closure of the Shanghai urban area has not yet been lifted.

The Shanghai districts of Pudong and Puxi remain closed until further notice:

-Most factories in Shanghai and surrounding areas remain closed

-Restrictions on overland transportation: -Shanghai trucks may move only with special permits

-Only 30 % of all trucks have received this special permit

-Drivers are not allowed to leave their cabs when making deliveries inside and outside Shanghai.

The container terminals and airport in Shanghai are in operation, but only limited volumes of FCL, LCL and air cargo can be transported due to strict restrictions on land transportation. The container yards and air cargo halls have reached their capacity limits.

Please note that due to these restrictions, higher trucking costs, possible port storage fees, demurrage and detention costs may apply.We use alternative sea and air ports whenever possible to handle your goods with minimal delays.

We kindly ask you to place your bookings as early as possible, as we expect an increased volume of shipments after the blocking has been lifted.

Source: Extract from a customer information LOGWIN - 07.04.2022

15.03.2022

Tighter measures in the Chinese metropolises of Shanghai and Qingdao

The number of COVID-19 cases in the Shanghai and Qingdao regions has continued to rise in recent days.

Residents of the two cities were asked not to leave the region until further notice. In addition, local control measures were tightened:

-Truck drivers must present a negative COVID-19 test that is no more than 48 hours old.

-The stricter control measures lead to delays in the pre- and post-production

-Bordering regions do not accept drivers from the Shanghai and Qingdao risk areas.

Handling at the airports and seaports of Shanghai and Qingdaol is currently continuing.

However, local COVID-19 measures and restrictions result in limited availability of driving personnel and short-term shifts in pickup and delivery.

Please be prepared for possible delays in local shipments to and from these regions in the coming weeks.

Source: Extract from a customer information LOGWIN - 15.03.2022

15.03.2022

Local Chinese authorities order lockdown for Shenzhen / Yantian

In recent days, the number of COVID-19 cases has increased rapidly in the Shenzhen metropolitan region.

To counteract this development, the local government has ordered a lockdown from March 14-March 20, 2022. All companies are

obligated to transfer your activities to the home office or to stop work during the aforementioned period. The consequences are:

-The production in Shenzhen will be shut down

-Additional restrictions and control measures in the Dongguan region.

-The LCL activities in the warehouses of Shenzhen& Yantianwere discontinued

Handling at Shenzhen's sea terminals(Chiwan, Shekou, Yantianand Da Chan Bay) are currently not affected by the measures.

Please check with your suppliers in the region if there are any postponements of current shipments due to production.

Please book your shipments as early as possible, as we expect increased booking volume after the lockdown.

Source: Extract from a customer information LOGWIN - 15.03.2022

14.03.2022

Exploding energy prices and pallet shortages

The effects of the war in Ukraine are increasingly affecting all areas of our daily lives, including logistics. In addition to the already recognizable impact in the area of driver shortages, the price of diesel and also the rising price of pallets are obviously playing an important role.

Within one week alone, diesel prices have risen by an average of over 30 %. The immediate effects are felt by everyone who fills up privately. Particularly truck entrepreneurs, whose vehicles consume depending upon size and extent of utilization between 20 - 35 liters per hundred kilometers, fight ad hoc with cost increases of over 15,00 € per hundred km, or on an exemplary driving performance of 600 km calculated, with more than 90,00 € per day and vehicle, dimensions as it never gave it before.

In addition to the actual amount, it is above all the dynamics that pose extreme challenges for transport companies and freight forwarders here. Diesel surcharges were usually calculated on the basis of average values from previous months, and adjustments were usually made with a significant time lag. However, the current situation requires us to take the extreme situation into account promptly and react more quickly here.

We will therefore no longer link the stored diesel price models to the previous month's values, but take into account the development at weekly level. We must also pay particular attention to partial and full loads, as the diesel surcharges here are often out of proportion to the actual additional charges. This also applies in particular to international full truck loads. We ask for your understanding that in individual cases there may be an increased diesel surcharge for such transports.

But the availability of pallets is also affected by the war, as the production and supply situation of pallet wood and pallets is interrupted. Already for months, the cost of euro pallets has more than doubled. At the beginning of the year, fortunately, there were slight signs of relief, but due to the war and sanctions, unfortunately, the situation has again developed exactly in the other direction. It is realistic to fear that not only prices will continue to rise again, but that an increasing shortage will develop.

Everyone in the transport chains must coordinate closely and in partnership in order to master this complex and cost-intensive issue together. This concerns the costs for pallet exchange, but also the depreciation of quantities, as well as very practically any depreciation of damaged or not nice pallets on delivery. Only by dealing fairly can cost explosions and bottlenecks be avoided here.

You can be sure that even in these difficult times Schmidt-Gevelsberg is working very intensively with its long-standing network partners and transport companies to be able to meet every one of your logistical requirements in the best possible way.

Source: Extract from a customer information of the forwarding company Schmidt-Gevelsberg - 14.03.2022

21.02.2022

Hurricane-force storms bring handling to a standstill at terminals in northern Europe

Three successive hurricane lows have been moving across Northern Europe since February 18.

All modes of transport are still affected in their operations:

-Rail freight traffic to and from the seaports is severely delayed.

-The transshipment in the seaports had to be suspended several times, loading closures, departures and arrivals are out of the schedule.

-Some of the flights have been cancelled or are delayed

-Existing reservations were lost and time slots had to be re-booked

Airports will soon make up for lost time. Rail services and seaport terminals, on the other hand, will need the following weeks to return to normal operations.

Therefore, please expect longer transit times, last-minute schedule changes and further delays.

We ask for your understanding that there may be demurrage, storage charges and costs for demurrage and detention, which are to be borne by the cargo owner.

Source: Extract from a customer information of the company LOGWIN - 21.02.2022

09.12.2021

Imports from China / Far East / Subcontinent

We are facing very turbulent times in every respect and unprecedented challenges in global logistics. Reliable processes and fixed schedules have not existed in most trades worldwide. Even if you sometimes think that things are returning to normal here or there: A real turnaround to old rates and familiar reliability is not yet in sight.

Regarding rate developments, with the exception of dangerous goods and heavy 20'Contanians, there have been slightly lower rates in the market in recent weeks. This is mainly due to the fact that the departures were such that the goods would have arrived in DE at Christmas or New Year, which hardly anyone wanted. The actually expected rate increases from the beginning of December have surprisingly not yet occurred. Is it now due to lower demand and / or articles that were simply not bought at the high rate level in Asia? No one can say for sure. However, the space on the ships is becoming scarce again and we therefore probably still expect rate increases from mid-December, although we hope that the previous highs will not be reached again in 2021 or at least will no longer be exceeded.

The reason, of course, is that Chinese New Year is celebrated from February 1. This is when the Year of the Tiger begins in China. Until then, space will probably become scarcer and more expensive again, but after that we assume a somewhat lower rate level than we had for the most part in 2021. However, the situation at present may come to a head considerably as a result of news in the last few days. For example, China is still struggling with the pandemic. New Covid-19 outbreaks in Ningbo, Hangzhou, Shanghai and Zhejiang province are expected to lead to factory closures in these regions(!) which could affect many of you. There are talks about 14-day closures of the factories. Already longer in the discussion are early closures of the companies in several parts of China starting from 14 January. This will significantly extend the holidays and will also greatly curb the virus. As if that were not enough, the Winter Olympics are coming to China (February 4-20 in Beijing). Business closures are planned in the Beijing, Tianjin, Qingdao, Dalian regions from January 1 to February 28. Be sure to clarify with your suppliers in good time, if you have not already done so, whether and to what extent the production of your goods will also be affected. Currently, production is often under high pressure and they try to ship everything that is possible beforehand. Due to the holidays there will be blanc sailings in the shipping industry, i.e. departures will be cancelled completely.

Rail freight - here we have had terrible months with very long and, above all, completely unplannable transit times. However, things seem to be improving slowly, some trains are back in Hamburg or Duisburg after 3 weeks, but others have been stuck in Kaliningrad for 5 weeks, for example, and need approx. 8 weeks to reach Hamburg. The situation in Hamburg regarding the unloading of containers has improved slightly, but it still often takes 4-5 days until shipments can be accepted. However, the main warehouse keepers in Hamburg(PCH, DCP, Contex and HLS) are very busy and there are often considerable waiting times for the truck entrepreneurs, which are an additional burden for us. Please understand if we have to charge these to you according to the display.

Air freight - the problems with sea and rail continue to keep air freight busy. Flights are heavily booked now before Christmas, hopefully this will return to normal after CNY. At Frankfurt Airport, the situation at FCS has improved significantly after many months. This was certainly due to the fact that the airport has signed a new contract with FCS for the next few years. There are no longer significant waiting times as often.

Truck/RAIL - In Germany, both modes of transport are traditionally very busy before the holidays. Anyone who still wants to have important items transported before Christmas has to take care of it very quickly. Truck transport in particular has risen significantly in terms of costs - many trucking companies are raising prices by around 8 percent in the new year.

Quay tariff Hamburg/Bremen - the tariffs have been increased since September 1.

Source: Extract from a customer information of E. Gallmeister GmbH Internationale Spedition - 09.12.2021

15.09.2021

High unreliability of global container shipping continues

The situation in global maritime freight traffic, which has been tense for months, has not improved:

The necessary measures and regulations to contain the Covid 19 pandemic have disrupted supply chains worldwide. Nationwide lockdowns and, most recently, spontaneous terminal closures at major seaports are having a lasting impact on the flow of goods. Shipping companies reserve the right not to call at ports at short notice. Ship arrivals and departures are delayed by up to 14 days.

Please continue to expect longer transit times, short-term changes to timetables and ongoing ship delays in the coming weeks. We will do our utmost to continue to provide you with the necessary shipping space and to maintain the flow of information. If you have any questions, please do not hesitate to contact your Logwin representative.

Source: Extract from a customer information of the company LOGWIN - 10.09.2021

14.09.2021

Container ships stuck in traffic jams outside US ports are putting unprecedented strain on global supply chains. Waiting times exceed eight days, a new record in the pandemic.

The average wait rose to 8.5 days, up from 7.6 days at the end of August, Bloomberg reports, citing the Port of Los Angeles. More than 55 ships jammed off the California coast over the weekend, off Los Angeles and Long Beach. Their combined cargo capacity was equivalent to about 375,000 20-foot containers, it said. Due to the extreme congestion, there were no more anchorages, so that a record number of 17 ships had to wait in so-called drift zones.

Hapag-Lloyd: Normalisation in 2022 at the earliest

German shipping line Hapag-Lloyd expects the situation in container shipping to return to normal in the first quarter of 2022 at the earliest. Demand has risen dramatically due to economic stimulus programs around the world, he said. "We are doing what we can," a spokesman said. Given the economic growth, he said, containers had been ordered and also a total of twelve container ships of 23,500+ TEU. However, the giants cannot be delivered until 2023. Currently, the charter market is completely empty, the spokesman said. He saw bottlenecks in particular on the land side at ports, terminals and hinterland transport.

There can be little talk of schedule adherence among the major shipping lines as a whole, with it hovering between 35 percent and 40 percent since the start of the year until the end of July, reports supply chain analyst Sea-Intelligence. According to the report, on-time performance fell 3.8 percentage points month-on-month to 35.6 percent in July 2021. "Year-over-year, the on-time rate actually dropped 39.7 percentage points," CEO Alan Murphy points out.

Niche shipowners more reliable

Smaller container lines are far more reliable than industry giants such as Maersk or CMA CGM, Sea Intelligence notes. The difference in performance is greater than it has been since 2011. In June and July, niche shipping companies were eight to eleven percent more punctual than their large competitors.

Maersk Line was the most reliable of the 14 largest shipping companies in July 2021, with a rate of 47.3 per cent. Hamburg Süd was the only other shipping line with a punctuality rate of more than 40 per cent. Only four shipping lines were between 30 per cent and 40 per cent, including Hapag-Lloyd. Six others scored between 20 per cent and 30 per cent and the remaining two were below 20 per cent. Evergreen had the lowest schedule reliability in July 2021 at 16.2 percent.

Source: https://www.eurotransport.de/artikel/komplett-gestoerte-lieferketten-container-stau-bis-2022-reeder-hapag-lloyd-maersk-11190655.html – 14.09.2021

06.09.2021

Civil war drives up the price of aluminium

Dhe price of aluminium rose to its highest level in more than a decade at the beginning of the week. Unrest in Guinea is fuelling concerns about supplies of the industrial metal. Military units have seized power in the African country and suspended the constitution. The head of the special forces, Colonel Mamady Doumbouya, called on the army to support him.

The price of aluminium for immediate delivery rose to $2,775.50 a tonne in London. Only about $15 now separates it from the 2011 peak. In Shanghai, prices climbed as high as 21,635 yuan, the highest level since 2006. Guinea is a major supplier of the raw material bauxite - political instability raises the possibility of supply disruptions. The impact on exports is difficult to assess so far, however, because news of the coup is still fresh, says one stockbroker.

Meanwhile, Aluminium Corporation of China, the largest aluminium producer, which also operates a bauxite project in Guinea, said operations were running normally and there was more than enough bauxite at its plants in China. Still, its share price rose as much as 10 percent in Hong Kong.

The market could be "severely shaken" by the situation, the founder of metal producer Rusal, Oleg Deripaska, let slip via the Telegram messaging service. the company's share price, meanwhile, rose 14 percent in Hong Kong to its highest level since 2012.

The price of aluminium has already risen by about 38 per cent in London this year. This is because while massive global stimulus measures have boosted demand, manufacturing plants in China, the largest producer of aluminium, have struggled to maintain production in the wake of a seasonal power shortage. In addition, the leadership in Beijing is trying to reduce the country's CO2 emissions and therefore tends to limit the high-emission production of aluminium. More than half of all Chinese bauxite imports come from Guinea. Investors are quite concerned about this, Xiong Hui, senior aluminium analyst at Beijing Antaike told Bloomberg news agency.

China accounts for around 60 per cent of global production, but has also committed itself to securing supplies and releasing metal from state reserves to alleviate shortages due to existing concerns. Nevertheless, the country is currently increasingly reliant on imports. This rather unusual development has put a strain on global supplies of the normally abundant metal.

The price of aluminium had fallen significantly at the beginning of the Corona pandemic. However, with higher consumer demand and economic activity, it rose sharply to its current level. In the longer term, experts expect use in electric vehicles and renewable energy applications to boost the price.

Source: https://www.faz.net/aktuell/finanzen/putsch-in-guinea-treibt-aluminium-preis-auf-rekordhoch-17523413.html – 06.09.2021

Source: https://www.lme.com/en/Metals/Non-ferrous/LME-Aluminium#Price+graphs – 27.09.2021

01.09.2021

Alluminium as expensive

as last 2011

With prices at US$2,730 per tonne, aluminium is more expensive than it was ten years ago. The upward trend, which began in April 2020 at 1,455 US dollars per tonne, is thus continuing. The price of aluminium has risen by more than 35 per cent since the beginning of the year alone. China, which is responsible for 60 per cent of global supply, is providing the tailwind for prices.

As aluminium production is very energy-intensive and China wants to limit energy consumption from an environmental point of view, the production of aluminium in the provinces of Xinjiang and Guangxi has been scaled down. China is currently releasing state reserves to increase supply, but apparently not enough to meet demand.

Aluminium is used, for example, in car parts, beverage cans and household appliances. Demand is likely to increase in the future due to the boom in electromobility and renewable energies. It is also interesting for the aircraft industry because of its low specific weight. This means that a decades-long era of oversupply could be coming to an end. Aluminium producers should benefit from this.

Source: Deutsche Bank Newsletter - Tomorrow's Perspectives - 01.09.2021

01.09.2021

Boost for

Aluminium prices

Clean air is important to the administration in China for next year's Winter Olympics. Already in the spring several Chinese provinces began to restrict the often CO2-intensive electricity consumption of the metal industry. At the weekend the power grid operator of the Chinese province of Guangxi called on the aluminium producers operating there to reduce their electricity consumption from coal-fired power by 30 percent in order to be able to guarantee a stable power supply for the population in the province. This measure could

according to the statement, will last until May 2022. In Guangxi province alone, more than 500 kilotonnes of annual aluminium production capacity is expected to be temporarily eliminated. Together with the restrictions in other provinces, this will temporarily eliminate about 2.4 million tonnes of China's annual aluminium production capacity. China covers additional demand with stocks from reserves

and by imports. This should give the aluminium price a further boost in view of sustained demand. European and North American aluminium producers could then benefit from this.

Source: Deutsche Bank Newsletter - Tomorrow's Perspectives - 01.09.2021

12.08.2021

Hapag-Lloyd expects easing of

Supply chains at the beginning of 2022 at the earliest

The market situation will not ease until the first quarter of next year at the earliest, predicts shipping company boss Habben Jansen. The prices for container transports are exploding.

At the end of June, Hapag-Lloyd CEO Rolf Habben Jansen was still expecting the delivery problems to ease in the autumn. Now, however, the outlook is darkening for the CEO of the world's fifth-largest container shipping line. "Looking at the market environment today, we don't think the situation will normalize quickly," he said Thursday when presenting quarterly figures. Despite all efforts

and the additional container capacities that will be brought onto the market, it is currently assumed that the market situation will not ease until the first quarter of 2022 at the earliest.

The closure of the Chinese port of Ningbo near Shanghai, which is the largest port in the world with an annual throughput of 1.17 billion tonnes, has caused enormous uncertainty since this week. There, the authorities had tested a terminal employee positive for Corona and subsequently ordered a closure. The German Association of Materials Management, Purchasing and Logistics (BME) believes it is conceivable that supply bottlenecks could now occur again, as they did in May and June 2021.

At that time, the southern Chinese port of Yantian was partially closed for around a month after Covid 19 infections also occurred there. The congestion of container ships then proved to be even greater than a few weeks earlier during the blockade of the Suez Canal.

container ships. According to figures from the market research firm IHS Markit, which specializes in maritime shipping, the new orders recorded in the order books currently represent just 17 percent of the global fleet - after only ten percent in 2018 and 2019. In 2011, the ratio was still over 25 percent.

In addition, the ships ordered will not be delivered for two to three years, which does not eliminate the current delivery bottlenecks.

helps. Accordingly, charter prices for liner shipping companies such as Hapag-Lloyd, , MSC or CMA CGM are skyrocketing. On Thursday, the Greek shipowner Euroseas announced that it had sublet one of its container ships at a premium of 315 percent to the previous charter rate.

High warehousing revenues due to persistent ship delays

The Hamburg port operator also benefited in the past half-year from the increasing chaos in maritime trade. Despite the continuing impact of the coronavirus pandemic, the Group's operating result (Ebit) rose by 63.2 percent year-on-year to 90.5 million euros, Chief Executive Officer Angela Titzrath reported on Thursday. Although container throughput rose by only 0.7 percent, "high storage fee income as a result of persistent ship delays in the Port of Hamburg" in particular contributed to the positive business development - as did container transport by rail, which HHLA also offers. The shortage of shipping capacity is causing prices for container transport on important routes to explode. According to the Shanghai Containerizedn Freight Index (SCFI), for example, the average standard container (TEU) costs 4226 dollars this week, almost 30 dollars more than in the previous week. In August two years ago, the price was still around 700 dollars.

Accordingly, Hapag-Lloyd's profit for the half-year increased tenfold year-on-year to 2.7 billion euros. "We are of course delighted with this particular financial result," Habben Jansen said. However, he said supply chain bottlenecks continued to cause huge burdens and inefficiencies for all market participants. "We need to do everything we can to address them together as quickly as possible." Within the company itself, the average freight rate went up 46 percent to just over $1,600 per standard container, Hapag-Lloyd reported. Habben Jansen explained the comparatively moderate increase by the fact that part of the transport orders were booked on a long-term basis and were not sold on the hot spot market. "For some time now, the Hapag boss has been criticising the industry's reluctance to place new orders for ships.

"You could clearly do more",

he said. Habben Jansen itself had ordered six large containerships in June, bringing its order book to twelve vessels, each capable of carrying 23,500 standard containers. The first six mega-freighters are to be delivered in 2023, with the rest a year later. At the end of 2022, Hapag-Lloyd expects to receive a number of smaller ships. The Hamburg-based shipowner also expects strong earnings in the second half of the year. For the full year, earnings before interest, taxes, depreciation and amortization (Ebitda) are expected to be between €7.6 billion and €9.3 billion, with Ebit of between €6.2 billion and €7.9 billion.

Germany's largest shipping company had already raised its forecast at the end of June following a jump in earnings in the first half of the year. Shareholders can already look forward: "Of course we will pay a very high dividend next year," Habben Jansen announced.

Source: https://www.handelsblatt.com/unternehmen/handel-konsumgueter/reederei-hapag-lloyd-erwartet-entspannung-der-lieferketten-fruehestens-anfan%E2%80%A6 – 12.08.2021

11.06.2021

Situation in South China ports

Due to a Covid 19 outbreak in southern China, the port of Yantian was closed from May 25 to 31, 2021 as a measure to contain the virus. The volume of cargo handled through Yantian caused an immediate backlog of cargo as well as congestion outside the port. A portion of the Yantian port has since reopened. However, only 30% of the workforce is currently working at the port, resulting in lower productivity. Hygiene measures further restrict access to the port for workers and also for truck drivers.

As a result, a large number of ships have skipped the port of Yantian. Some ships have been diverted to alternative ports in southern China. However, the ports in Nansha, Shekou and Hong Kong are unable to accommodate the backlog of cargo from Yantian. Moreover, customs formalities prevent cargo from being transferred from one port to another. In view of this situation, the market is facing cargo backlogs, ship delays, port failures and overwhelming cargo space demand. The Yantian situation adds to the uncertainty of rates and the overall capacity situation. Once ports resume normal operations, we expect cargoes to increase for another two to five weeks. Furthermore, additional ripple effects from the disruption of empty container flows back to South China should be expected.

are to be expected. The effects will persist globally and across all industries for at least two to three quarters.

Source: Excerpt from a customer information of the company Kuehne und Nagel - 11.06.2021

11.06.2021

South China Ports

under pressure

After Covid-19 outbreak in Yantian(Shenzhen), all ports in South China and also Hong Kong are heavily congested.

The global market has not yet fully compensated for the impact of the Suez Canal closure. In addition, the situation in the southern Chinese ports is now beginning to worsen.

Yantian and Nansh were closed at short notice. Hong Kong, Chiwan and Shekous are heavily congested; the backlog of containers is immense. Some container ships no longer call at Yantian; ships are diverted to other ports and have to wait a long time for their loading and unloading windows. It is to be expected that the shipping companies will introduce congestion surcharges in the short term.

In the coming weeks, please expect longer transit times, short-term postponements of schedules, continued ship delays and a further shortage in the availability of empty containers.

We ask you to send us a forecast of your planned shipments by at least the end of July and to instruct your suppliers to place the bookings as early as possible.

Source: Extract from a customer information of the company LOGWIN - 11.06.2021

11.06.2021

Port crisis in southern China: freight forwarders view it with concern

The Suez Canal crisis has not yet been properly digested at all, and yet another massive disruption of maritime supply chains is already on the horizon. Rising

Corona case numbers around the southern Chinese metropolis of Shenzhen are causing severe handling bottlenecks at the ports of Yantian and Shekou, as well as Nansha (in neighbouring Guangzhou). Maersk speaks of delays of up to 14 days.

Delivery stops and restrictions for export cargo as well as cancelled ship calls are the order of the day. So it is only a matter of time before the

wave has reached the ports in Northern Europe. Consequently, German seaport forwarders are already alarmed. Referring to the situation in China, Frank Huster, Managing Director of the DSLV Bundesverband Spedition und Logistik (German Freight Forwarders' and Logistics' Association), says: "We see this with concern." Admittedly, he says, no data has yet been received that there is a hitch. But should the problem continue to develop, there could also be a regression in the supply chains again.

Lars Jensen, CEO and partner of the consultancy Vespucci Maritime, fears a further escalation of the situation. He estimates that the effects will exceed those of the Suez crisis. According to him, Maersk already refers to 64 ships of the 2M Alliance that have to bypass the ports of Yantian and Shekou. One refers to 52 ships from THE Alliance. OOCL cited 26 units and CMA CGM 11 that were affected. As a result of the congestion, One has now already introduced a congestion surcharge for reefer cargoes bound for Yantian: As of June 10, US$1,000 per box

is levied. This was necessary in order to cushion the additional costs incurred for longer interim storage, re-routing or additional reefer connections.

Meanwhile, ship delays at Yantian Port, a deep-water port in Shenzhen, have already increased in the

successively worsened in the past week. And the supply chain platform provider from the USA is expecting a further increase in container traffic based on its data.

dwell time that the port remains congested throughout the month. According to this, the dwell times in Yantian vary greatly. The minimum is one day. The median, i.e. the measured value that lies exactly in the middle of all the individual dates, is given by Project44 as almost 18 days for containers waiting to be loaded (as of June 7). Authorities in Guangzhou, the industrial city northwest of Shenzhen, have also imposed restrictions on operations. "The Nansha port will also feel the impact of these restrictions, which will make the

congestion problem in Yantian further aggravated," Project44 further informs. As of June 7, 47 ships are approaching the port of Yantian, according to experts. According to the analysis, one third of the ships are already delayed.

"The recent spike in Covid 19 cases in China has created gridlock that could drive up the already record-high cost of shipping goods from China," says Josh Brazil, responsible for marketing at Project44. Last year, freight costs between China and the U.S. West Coast rose 156 percent, while the trade lane between China and the U.S. East Coast saw a 162 percent increase, according to the company. Freight rates between China and Northern Europe rose the most, by 535 percent.

Tense situation worsens

The development worries the German Association of Materials Management, Purchasing and Logistics (BME) in Eschborn. "The pandemic has not yet been defeated and we will have to live with Corona for some time to come," says Carsten Knauer, Head of Logistics/SCM at BME. Further delays or failures in the supply chains further affected the already tense situation on the transport markets. "In the short term, it is hardly possible to get alternative routes for shipments from China. Trucks, rail or air freight are already at capacity," Knauer continued. The BME continues to advise building up suppliers in additional markets and regions in the medium and long term to diversify the risk of failure or delays. The obstruction will mean additional empty runs from Yantian to Hong Kong and the US West Coast in June, Project44 predicts. The

Container capacity at the port could be reduced by about 50 percent, and there could be constraints on shipping lines providing high-value

be allowed to release shipping containers. For the trade routes between Asia and Europe, the shipping companies have announced that they will be using the ports in the north, such as Tianjin and

Quindao, citing congestion problems as the reason.

Difficult planning for importers

Nathan Resnick, CEO of US-based B2B procurement platform Sourcify, told business broadcaster CNBC that supply chains had been severely affected by the sudden and severe restrictions. He added that the situation would make it difficult for businesses to plan ahead in the coming quarters. "Especially with the holiday season coming up, many large importers are trying to plan their supply chain for Q3 and Q4." Asked which industries are likely to be hit the hardest, he replied, "Right now in Guangzhou and Guangdong, it's mainly household goods, shoes, consumer electronics and many other types of products." He added: "These delays at ports will lead to a further increase in freight rates and that's something we see continuously throughout the year." Ship movement data through the end of May already point to a slight month-on-month decline in China's imports and exports. The Kiel Trade Indicator of the Institute for the World Economy (IfW), for example, shows a negative sign for exports (minus 1.7 percent) and imports (minus 1.0 percent) respectively. Vincent Stamer, head of the leading indicator for global trade, said on request that it was not yet possible to make any statement beyond this. He refers to

the next update on the figures on 22 June. (sr/cs/rok)

Source: https://www.dvz.de/login.html?redirect_url=/rubriken/see/detail/news/hafenkrise-in-suedchina-spediteure-sehen-es-mit-sorge.html – 11.06.2021

12.05.2021

The price growth of the raw material wood surprises the entrepreneurs.

According to preliminary information, the prices for large-sized coniferous timber achieved at auctions are even more than 100 % higher than the average prices achieved at timber sales in the first half of the year. However, there are also auctions that end with even higher price increases.

In the auctions that have already ended, prices are higher for almost all assortments. There are also high price increases for medium sized softwood and beech sawnwood.

Prices of selected timber assortments: Average price in the timber and forestry portal for 2021, Average price in the system auctions for the first half of 2021, Prices of selected timber assortments: Average price from Timber and Forest Enterprise Portal for 2021, Average price from system auctions for the first half of 2021, Prices from randomly selected system auctions for the second half of 2021.Photo: Drewno.pl

Most traders participating in the auctions are surprised by the size of the increase. Companies that buy timber for export, mainly to China, Germany and the Czech Republic, are accused of charging raw material prices that are above the profitability threshold of production.

System auctions are one of the stages of timber sales conducted by the State Forests National Forest Holding. The volume of timber currently auctioned reaches approx. 10% of the volume of timber earmarked for the industry in 2021, i.e. approx. 3.5 million m³

Source: https://www.drewno.pl/artykuly/12081 - Translated from Polish. - 12.05.2021